Palace Amusement registered a major loss in the second quarter as shuttered cinemas caused a nosedive in its stock price and the company’s market value.

The cinema operator posted a loss of $49.2 million against a profit $43.7 million for the similar quarter of 2019, while core sales declined by 10 per cent to $229 million and other operating income was cut in half. Another income category for ‘non-operating’ inflows went from $46 million to zero.

The profit loss in the March third quarter wiped out all the bottom-line gains made by the company in the previous two periods. The one bright spot was that revenue over the nine months at $899 million was ahead of the 2019 period, when sales topped $774 million.

The cinema company is currently the single most expensive ordinary stock on the Jamaican Stock Exchange, a ranking it maintains despite taking a battering this month. From $2,789 on May 5, the stock traded at $1,300 on Friday, pushing its market value down to $1.87 billion.

The stocks that come closest in price are cross-listed MPC Clean Energy, which last traded at $151, and NCB Financial, at over $144.

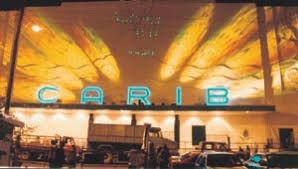

Palace Amusement announced the closure of all its cinemas effective March 14 following social distancing restrictions by the Government to control the spread of COVID-19. Even before that the company was facing challenges with its newest cinema, Sunshine Palace in Portmore, St Catherine, which was not performing as expected.

May marks the start of the usually busy blockbuster season for the cinema company but to date, and while the Jamaican government has announced the reopening of the economy on June 1, there is still no word from Palace on when it intends to restart operations.